We believe consistent engagement with companies can impact how management teams address key environmental, social and governance issues, and help to reduce credit risk. Engagement is a core part of the integration of ESG into our guiding principles behind the ESG processes and engagement activities that we have established across our Non-Investment Grade Credit platform.

Promoting ESG in Non-Investment Grade Credit

Over the past quarter, we have participated in panel discussions at the Bank of America Merrill Lynch High Yield Conference and the “Responsible Investment in Fixed Income: The Road Ahead” conference hosted by the UN-supported Principles for Responsible Investment (PRI).

Bank of America Merrill Lynch hosted a panel discussion titled “Environmental, Social, Governance: Integration into High Yield Investing” in November 2017, which we believe was the first panel of its kind at a major high yield conference. We were pleased to discuss the importance of ESG processes and engagement efforts with attendees.

PRI hosted a well-attended full-day fixed income conference in January. We were fortunate to have the opportunity to participate in a panel titled “ESG Engagement for Fixed Income Investors: Managing Risks, Enhancing Returns.” We detailed our opinions on establishing an ESG engagement platform and our outlook for growth of ESG in non-investment grade credit.

A Key Takeaway from These Recent Activities: Disclosure and Responsiveness Matter

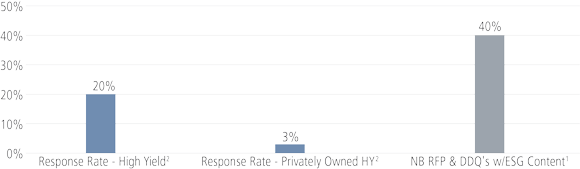

According to data provided by MSCI, a leading provider of ESG data and ratings, only a small percentage of high yield issuers—just 20% overall and only 3% of privately owned issuers—reviewed and confirmed the data that MSCI uses in their ratings. This is important because it indicates a lack of engagement by high yield issuers on ESG, may mean that MSCI’s ratings could be based on incomplete information, and reinforces the limited levels of ESG disclosure in this market. Contrast this with the approximately 40% of the Request For Proposals (RFP) and Due Diligence Questionnaires (DDQ) that we received for Non-Investment Grade Credit mandates from institutional clients in 2017 which sought disclosure on how we integrate ESG into our investment process.1 Clearly there is a disconnect between client demand and issuer disclosure, and we believe that persistent engagement with issuers over time will be the key to closing this gap.

1Source: Neuberger Berman. Represents Non-Investment Grade Credit Institutional Request For Proposals (RFP) and Due Diligence Questionnaires (DDQ) activity for calender year 2017.

2Source: MSCI. High yield response rate as measured by MSCI using the Barclays Global High Yield Index. Privately owned high yield response rate as per MSCI for non-publicly listed constituents of the Barclays Global High Yield Index.

Why Engage with Issuers?

| Rationale for Engagement | ||

|---|---|---|

| Credit Assessment | Impact | |

| Examples of Idiosyncratic Risks |

Examples of Secular Risks |

Examples of Initiatives |

|

|

|

How We Engage with Issuers

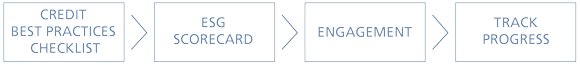

Neuberger Berman follows a systematic process that governs our engagement efforts. We consider engagement with management teams to be a critical component of our credit research process. Output from these activities is important in evaluating potential investments and in monitoring existing holdings in a proactive way.

Importantly, our Non-Investment Grade Credit research team is directly responsible for conducting our ESG assessment and engagement efforts. We believe this approach strengthens the depth of our efforts.

Examples of ESG Engagement

We have found that issuers are generally receptive to improving their ESG practices and disclosures, particularly when they are offered specific feedback and suggestions. To make continued progress in this area, broad-based engagement efforts will be required. Below are examples of our engagement efforts and outcomes across various industries.

| Objective | Engagement | Outcome | |

|---|---|---|---|

| Energy | Request for Additional Disclosure | Requested additional disclosure on a key operational issue Identified weaknesses in corporate governance and encouraged greater future transparency |

NB Non-IG Credit sold out of the position following inadequate issuer response |

| Healthcare | Evaluate New Issuance | Discussed aggressive pricing of medicines with senior management Identified lack of willingness to change current practices |

NB Non-IG Credit declined to invest in the issuer, which subsequently defaulted after facing pricing/volume pressures |

| Financials | Request for Additional Disclosure | Informed senior management of low thirdparty ESG scores and disclosure deficiencies | Issuer enhanced disclosures within 12 months Management member assigned to address ESG considerations |

| Cyclicals | Request for Company Action | Request to sign global agreement related to core business Joint engagement from NB Non-IG Credit and Equity teams |

Issuer is considering action NB Non-IG Credit tracking progress |

| Utilities | Issuer Education | Informed senior management team of importance of ESG transparency and disclosure | Positive response from senior-level management of issuer Next steps under evaluation at issuer NB Non-IG Credit tracking progress |

This material is intended as a broad overview of the portfolio managers’ style, philosophy and investment process and is subject to change without notice. See Disclosures at the end of this paper, which are an important part of this paper.

What’s Next in ESG Engagement Initiatives?

We intend to remain an active owner and investor as it relates to ESG. We recently completed the development of a proprietary ESG Scoring System, which will be the basis of our engagement activities going forward. Providing our investors with specific case studies and results is important to us. We intend to build upon our current momentum during 2018 and beyond, and we look forward to input and feedback as we partner on these important issues.