While dozens of distinct hedge-fund strategies have developed over the years, and dozens more styles within those strategies, at a high level the industry can be bifurcated into two camps. Traditional strategies are those which seek alpha but may be correlated to traditional equity, credit or other market risk premia. Uncorrelated strategies are those that seek alpha but have not historically demonstrated any meaningful correlation to traditional asset markets.

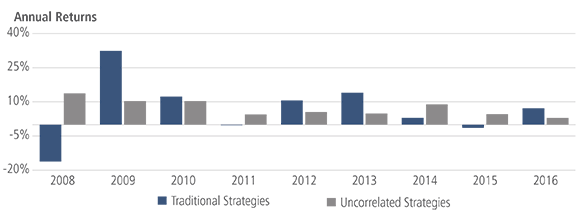

The traditional strategies enjoyed a hugely impressive 2009, as markets recovered from the financial crisis. Since then, while uncorrelated strategies have never posted a negative calendar year, they have lagged the traditional strategies in five out of the eight. It is understandable that some investors have tilted their hedge-fund portfolios towards traditional strategies as a result. Other portfolios will have naturally moved in this direction unless they have been deliberately rebalanced.

We think that is problematic. Not only are uncorrelated hedge funds an important strategic element that requires a meaningful weight in a portfolio, we also believe that economic and market conditions are changing in ways that suit them much better.

Fig.1 Traditional Strategies Have Outperformed Since the Financial Crisis

Source: NBAIM Peer Group data. Indices are constructed by taking the average of all monthly returns corresponding to either a Traditional Strategy or an Uncorrelated Strategy. Note that NBAIM peer group data consists of funds in existence as of Dec. 2016 and may contain survivorship bias. Info Ratio is calculated by dividing annualized return by annualized standard deviation (volatility).

What are “uncorrelated” strategies?

We define uncorrelated hedge fund strategies as those which demonstrate a correlation of no more than +/- 0.20 to equity or fixed income markets over a full business cycle. Unlike long-biased equity or credit long/short strategies, for example, they tend to derive substantially all their returns from market-agnostic trading strategies (for example market-neutral positions, short-term trading or relative-value strategies).

In simple terms, a manager with 50% in longs and 50% in shorts doesn’t care whether the broad market is going up or down; a trend-follower can jump on market moves regardless of whether a GDP print is good or bad, or rates are going up or down; and economic news means nothing to an investor collecting premia for re-insuring hurricane risk.

Among other niche strategies, we would categorise the following as leading uncorrelated strategies:

- Equity market-neutral / Statistical arbitrage

- Trend-following

- Short-term trading

- Systematic and discretionary global macro

- Volatility arbitrage

- Insurance-related securities

- Commodities arbitrage

- Fixed income arbitrage

Strong diversification benefits

What difference does all of this make? Using our proprietary peer group strategy data, we assembled a portfolio of traditional hedge fund strategies and one of uncorrelated strategies and backtested performance from January 2008 to December 2016. The calendar-year returns for each portfolio are shown in Figure 1. In addition, we observed that while the annualised returns of the two strategy groups were very similar, the uncorrelated-strategy portfolio exhibited around half the volatility, as well the lower market correlations we expected.

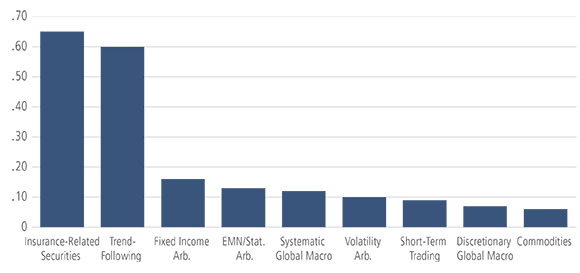

This is largely due to the very low levels of both inter- and intra-strategy correlation within the uncorrelated strategies group. This is not generally the case with the traditional strategies. Because they tend to exploit very idiosyncratic risks, uncorrelated hedge-fund strategies—fixed-income arbitrage and volatility arbitrage, or volatility arbitrage and short-term trading, for example—generally do not overlap one another very much. Furthermore, as figure 2 shows, outside trend-following and insurance-linked securities, even funds pursuing the same type of uncorrelated strategy tend to perform very differently from one another.

In addition to correlations, when building a portfolio it is also important to think about the size of the risk allocation to these strategies. As many of these strategies are available as managed accounts, it may be possible to apply increased risk budgets to the lower-volatility styles to ensure that their diversification benefits are felt at the whole-portfolio level.

Fig.2 Average Intra-Peer Group Correlations

Source: Neuberger Berman peer groups. Data from January 2008 to December 2016.

The attractive historical risk-adjusted returns of uncorrelated strategies are not a straightforward argument for ignoring the traditional strategies. As we saw earlier, in many recent years the traditional strategies posted better returns. Because traditional and uncorrelated strategies are exploiting different kinds of opportunity and risk, they generally exhibit low correlation with one another, and therefore a well-balanced portfolio of the two approaches can improve risk-adjusted return still further. We found that, over the 2008-2016 period, gradually adding uncorrelated strategies to a portfolio of traditional strategies both improved return and reduced volatility (Figure 3).

Fig.3 Adding Uncorrelated Strategies Has Improved Returns and Reduced Volatility

Source: Neuberger Berman hedge fund peer groups. Data from January 2008 to December 2016.

Why Now for Uncorrelated Strategies?

In general, we do not recommend trying to time entries and exits with uncorrelated strategies. Some, such as insurance-linked securities and volatility arbitrage, target market factors that are more readily observable and which an investor may have strong views about, but on the whole these are either all-weather strategies or deliver return streams that are notoriously difficult to predict. We feel that they ought to be strategic allocations.

Having said that, there are market conditions that suit some of them better, and we believe those conditions may be coming into play at the moment—and it therefore makes sense to ensure that portfolios have not drifted too far away from these uncorrelated strategies.

There is a new administration in Washington, DC, and while the ability of the administration to enact their favoured policies has been called into question more recently, tax reform, fiscal spending and the debt ceiling, and a focus on re-writing trade agreements and immigration law are all potentially disruptive forces that could lead to higher volatility and uncertainty.

On the monetary policy front, quantitative easing is over in the U.S., and the Fed has embarked upon the first rate hiking cycle in over 10 years. The Bank of England and Bank of Canada have also been making more hawkish noises of late, while strong fundamental data out of Europe could see the European Central Bank make announcements on its own QE-tapering plans soon. On the other hand, there is still no sign of the Bank of Japan giving up on its asset-purchase program.

The U.S. is now in its fourth longest economic expansion since the mid-1800s, and the equity bull market just passed its eighth year. We can’t predict with any degree of certainty when this ends, but it will eventually.

In Europe, while a lot of political risk appears to have dissipated following Dutch, French and German local election results, as well as the recent agreement to release funds for Greece, the general election in the U.K. has only added to the considerable complexity and inherent uncertainty of Brexit negotiations, which finally got underway on 19 June.

Elsewhere around the world, China still struggles to maintain its growth rate in the face of stress in its banking system and housing market, and a corporate debt burden of 160% of GDP. In emerging markets generally, concerns include the $3 trillion in dollar-denominated debt issued by non-bank borrowers, and geopolitical risks emanating from Russia, North Korea and the Middle East. Meanwhile, Japan looks set to continue with a QE program that dwarfs the one implemented in the U.S.

Exploring the Opportunity Set

It appears to us that the variability of future outcomes for markets is increasing—but you wouldn’t notice it by looking at the markets themselves. If and when volatility returns, investors can expect it to prove difficult for traditional, more market-sensitive hedge-fund strategies, as it has in the past.

With respect to uncorrelated strategies, we would offer the following views:

- Policy divergence and fiscal stimulus: Fixed income relative value, and interest rate and FX-focused global macro strategies should see an expanded opportunity set as volatility in the forward path of interest rates increases, and as U.S. policy diverges from the rest of the world. If we do eventually see tax reductions in the U.S., the stimulative effects could be a catalyst for capital movement, with implications for exchange rates. The debt-ceiling debate after the summer will be an early test for the new U.S. administration’s fiscal plans: if that proves an obstacle, market volatility will surely follow; if the obstacle is cleared and a fiscal plan makes it through Congress, debt issuance could lead to increased opportunities for managers to trade around auctions, or to trade relative value across the yield curve.

- Increased equity market volatility and dispersion: Both fundamentally-oriented equity market neutral and technically-oriented statistical arbitrage strategies have generally performed better when equity market volatility is high, and when single-stock correlations are below long-term averages.

- Higher interest rates: Higher rates are generally beneficial for strategies that depend upon derivatives, such as CTA trend-following and fixed-income relative value, which maintain large unencumbered cash balances.

In summary, we would observe that, while some uncorrelated strategies have failed to distinguish themselves in recent years, we believe that as a group they are effective portfolio diversifiers that have a role to play in every well-constructed hedge fund portfolio, and many of them could benefit from tailwinds in the current market environment. Finally, we would emphasize that investors should embrace the volatility embedded in many of these strategies, and not be shy about sizing-up the lower-volatility strategies to ensure they do their job as diversifying alpha producers at the whole-portfolio level.